Macroeconomic Policy and Financial Markets Program

Learn central issues in Macroeconomic and Financial Economics analysis.

full time

About this Master’s program

Students in the BSE Macroeconomic Policy and Financial Markets Program will obtain relevant knowledge about the central issues in Macroeconomic and Financial Economics analysis.

They will also learn the key tools, data, models, and techniques now being used by public and private institutions.

Policy-makers are often forced to make decisions under conditions of uncertainty, but the results of these decisions may directly influence a country’s overall economic performance. While a thorough understanding of aggregate economy dynamics is necessary for success, it is not entirely sufficient. Organizations must also be knowledgeable of the many sources of aggregate risk and uncertainty, and must rely on the analytical tools available to study the aggregate economy.

Financial and consulting firms increasingly utilize complex economic theories. Students will not only learn how to use these modeling and statistical techniques, but will conduct an independent master’s project to learn how to apply these new skills to real empirical work.

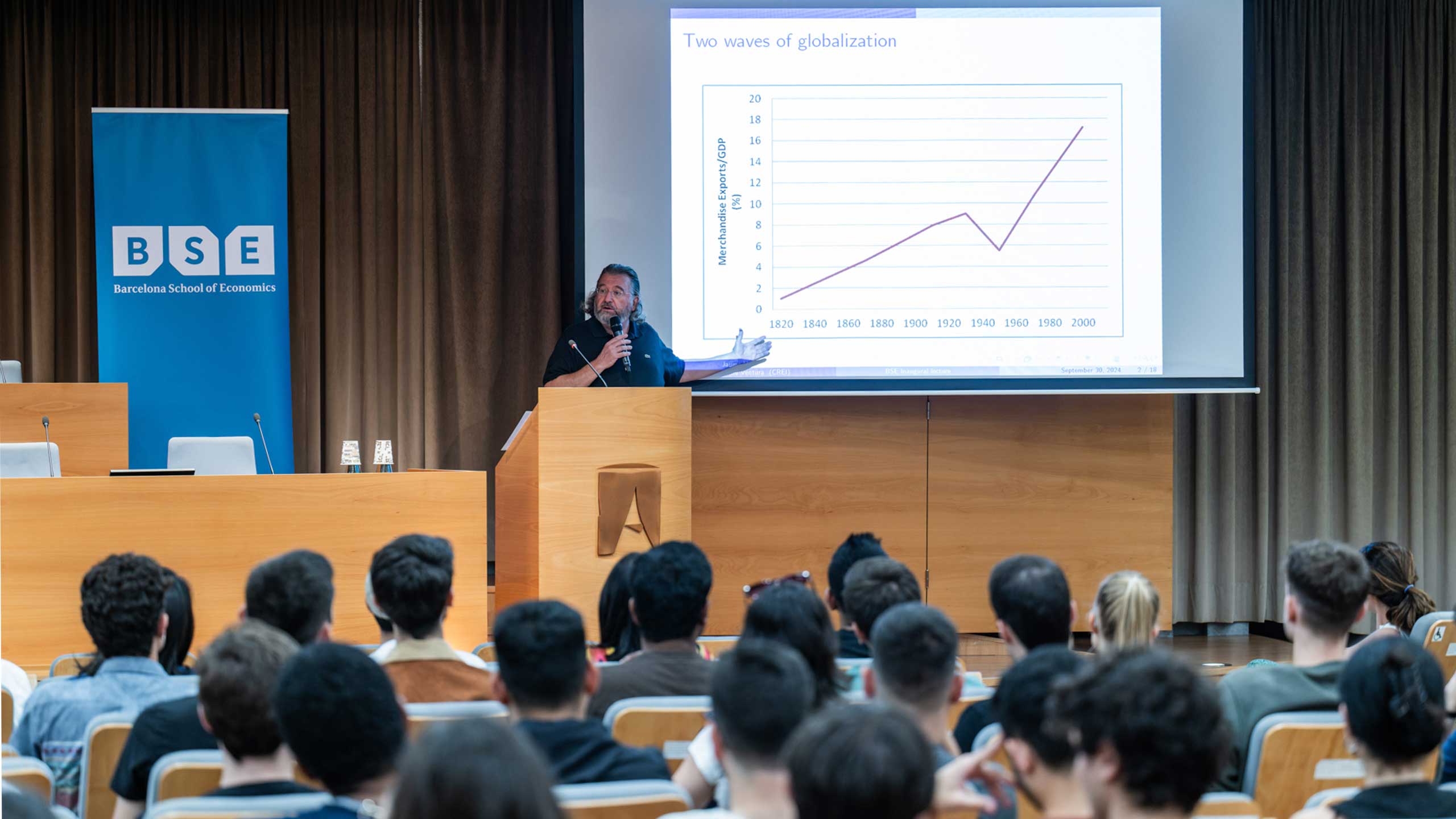

Our program also offers students guest seminars and lectures by international academics and practitioners.

This program covers economic techniques such as dynamic stochastic general equilibrium (DSGE), vector autoregression (VAR), nowcasting and forecasting as well as data science and machine learning. Our graduates are prepared with an expert grasp of aggregate economy and financial fundamentals and can build macroeconomic and market forecasts – skills that consulting firms, investment banks, and government agencies are all in need of.

Given the applied, quantitative nature of this program, students will need to furnish their own laptop computer.

Discover what makes this program truly exceptional

In-depth Knowledge: Comprehensive understanding of macroeconomic and financial economics analysis.

Learn Advanced Skills: Training in cutting-edge economic techniques and data science tools DSGE, VAR, nowcasting, and forecasting.

Expert Faculty and Guest Lectures: Taught by internationally renowned professors and practitioners.

Strong Career Support: Graduates are frequently placed in central banks, consulting firms, financial institutions, and government and authorities.

Meet the Program Directors

Hugo Rodríguez Mendizábal

PhD, University of Chicago

Albert Marcet

PhD, University of Minnesota

Ready to make a difference? This program is designed for

Students who are passionate about issues in Macroeconomic and Financial Economics analysis. Here’s why it is perfect for you:

- You have a background in Economics, Business Administration, and Engineering.

- You are a Junior analyst looking to improve your profile.

- You want to do a PhD after a rigorous master’s.

Professors

BSE Professors are renowned researchers who are published in leading Economics Journals.

Argimiro Arratia

PhD, University of Wisconsin

Fernando Broner

PhD, Massachusetts Institute of Technology

Jordi Caballé

PhD, University of Pennsylvania

Eudald Canadell

MSc in Economics, University of Minnesota

Davide Debortoli

PhD, Universitat Pompeu Fabra

Javier Fernández-Blanco

PhD, University of Minnesota

Luca Fornaro

PhD, London School of Economics

Luca Gambetti

PhD, Universitat Pompeu Fabra

Joan Llull

PhD, CEMFI

Albert Marcet

PhD, University of Minnesota

Francesc Obiols-Homs

PhD, Universitat Pompeu Fabra

Gabriel Pérez-Quirós

PhD, University of California San Diego

Hugo Rodríguez Mendizábal

PhD, University of Chicago

Luis E. Rojas

André B.M. Souza

PhD, UPF

Maite Cabeza Gutés

PhD, University of California Davis

Michael Creel

PhD, University of California-Davis

Pau Roldan-Blanco

PhD, New York University

Andre Groeger

PhD, Goethe University Frankfurt

Program Schedule

In September, students will have the opportunity to take brush-up courses in Mathematics and Statistics, Stata and Matlab. These courses are not mandatory but highly recommended to assure a smooth start.

Students will also have the opportunity to take brush-up courses in Coding in R and Coding in Python. These two courses are mandatory for those students who want to take Foundations of Data Science in Term 1.

Term 1 (September - December)

| Course title | Credits | Professor(s) |

|---|---|---|

| Mandatory | ||

| Macroeconomics | 6 | Francesc Obiols-Homs, Pau Roldan-Blanco |

| Foundations in Equilibrium Analysis | 3 | Hugo Rodríguez Mendizábal |

| Quantitative and Statistical Methods I | 6 | Maite Cabeza Gutés, Michael Creel |

| Finance | 3 | Albert Marcet |

| Electives (Choose from 0 to 3 ECTS) | ||

| Foundations of Data Science | 3 | André B.M. Souza |

Term 2 (January - March)

| Course title | Credits | Professor(s) |

|---|---|---|

| Mandatory | ||

| Quantitative and Statistical Methods II | 6 | Luca Gambetti |

| Electives (Choose from 9 to 12 ECTS) | ||

| Macroeconomics of Labor Markets | 3 | Javier Fernández-Blanco |

| Financial Economics | 3 | Jordi Caballé |

| Fiscal Policy | 3 | Davide Debortoli |

| Panel Data, Discrete Choice, and Duration Models | 3 | Joan Llull |

| Macroeconomics with Financial Frictions | 3 | Sarolta Laczó |

Term 3 (April - June)

| Course title | Credits | Professor(s) |

|---|---|---|

| Mandatory | ||

| Master Project | 6 | Luis E. Rojas, Luca Gambetti |

| Policy Lessons* | 3 | Gabriel Pérez-Quirós, Eudald Canadell |

| Electives (Choose from 9 to 15 ECTS) | ||

| Monetary Policy | 3 | Luca Fornaro |

| Sovereign Debt and International Financial Markets | 3 | Fernando Broner |

| Advanced Time Seires: Nowcasting & Forecasting** | 3 | Gabriel Pérez-Quirós |

| Machine Learning for Finance* | 3 | Argimiro Arratia |

| Economic Geography and Climate Change | 3 | Andre Groeger |

Master’s Project

Examples of Master's Projects

Class of 2023

- Fiscal Insurance During Financial Distress by Deema Alturki, Emil Bernstein, and Isabella Lara White.

- Banking Crisis Prediction: Exploring the Role of Text-Based Indicators by Ferran García and Timothy Hunter.

Class of 2022

- An Unfair Affair? Inequality Spillovers of US Monetary Policy by Bernice Batungbacal, Maria Paula Contreras, Diego Martínez.

- Burning Growth: Rising Temperatures in a Growth-at-Risk Approach. A Case Study of Colombia by Camila Camilo, Angie Rozada, and Carlos Sanz.

Class of 2021

- The Macroeconomics of Fighting Climate Change: Estimating the Impact of Carbon Taxes, Public and Private R&D Investment in Low-Carbon Technologies on the Scandinavian Economy by Astrid Esparza Sánchez, Benedikt Höcherl, and Wei Liam Yap.

Master’s degree awarded by UAB and UPF

Upon successful completion of the BSE Macroeconomic Policy and Financial Markets Program, students will receive a Master’s Degree in Specialized Economics Analysis awarded jointly with Universitat Autònoma de Barcelona (UAB) and Universitat Pompeu Fabra (UPF).

All Barcelona School of Economics Master’s degrees have been recognized by the Catalan and Spanish Education authorities within the framework of the Bologna Process (in Spanish, “Master Universitario o Master Oficial”).

Placement Rate, 2024 Cohort

Within 6 months of graduation:

- Job titles: Junior Economist, Market Researcher, Research Assistant, Senior Analyst, Economist

- Industries: Government & Authorities (33%), Consulting (25%), Financial Services (17%)

- Companies: European Central Bank, BBVA Research, Oxford Economics, Fitch Ratings, PwC, Goldman Sachs

- Higher Education: 8% do a PhD or further education.

Work Internationally

Cities with the most alumni

Testimonials

Liliana Cruz

The Macroeconomic Policy and Financial Markets Program gave me the ability to analyze things from a wide perspective and it also gave me a lot of quantitative tools that I am using in my work to do forecasting and other tasks. The quality of the teachers is stunning and this really makes the difference from other programs

Rana Mohie

The Master’s Program had a lot of practice and this impressed me a lot. I thought it would be mostly studying theories and topics reading papers, but we got a lot of knowledge and we went in-depth into using tools and coding.

Luciano Magnifico

Studying in Barcelona, and particularly being part of the Master in Macroeconomic Policy and Financial Markets, has been one of the most fulfilling journeys of my life. This opportunity combined exposure to an internationally renowned faculty with the chance to collaborate with a group of young professionals with immense potential, from whom I will carry valuable lessons for my future career. I believe the program strikes an excellent balance between theoretical analysis and practical applications that will be beneficial for any upcoming professional or academic endeavors.

Why study a Master’s at BSE

Ranked among the top institutions for economics research in the world by RePEc.

Prestigious economists including Nobel Laureates guide the development of BSE Master’s.

Learn from well-renowned faculty.

Study in vibrant Barcelona.

Admissions and Entry Requirements

At BSE, we look for excellence. Key elements of a strong application are a high GPA, a sound statement of purpose, and standout reference letters. Strong knowledge of Economics and good quantitative skills are also recommended.

Requirements:

- An undergraduate/bachelor/grado/laurea, or equivalent degree from an accredited college or university (for Bologna degrees, a minimum of 180 ECTS are required).

- University diploma in Economics, Finance, Engineering, Mathematics, Statistics, or Business Administration. Students with academic backgrounds in other subjects will be considered.

- An advanced level of English language skills: TOEFL score of 90 or above; IELTS Academic Test score of 6.5 or above.

Candidates will also be evaluated on the following admission criteria:

- Outstanding academic record.

- Quantitative skills.

- Reference letters.

FAQ

Below you will find our most frequently asked questions but do not hesitate to contact the BSE Admissions Team to learn more about our Master’s programs.

What are the most common student profiles in the Macroeconomic Policy and Financial Markets Program?

21 students from 12 countries (62% international) in 2024-2025

Most represented countries this year:

- Spain (8)

- India, Italy (2 students each)

Most common academic backgrounds:

- Economics (19)

Years of work experience:

- 0-1 years (11)

- 1-2 years (2)

- 2-3 years (2)

- 3 years and above (6)

Who hires Macroeconomic Policy and Financial Markets Program graduates?

Graduates of the Macroeconomic Policy and Financial Markets Program secure roles across sectors such as government and authorities, consulting, and financial services. Learn more about the specific positions, companies, and locations of these placements (cohorts of 2021, 2022 and 2023) in this document.

Is BSE listed in any higher education or research rankings?

Here you will find the Rankings that the Barcelona School of Economics is listed in.

Can I apply to more than one program?

You can apply to up to three different programs on your application for the same academic year.

How can I apply for tuition funding?

We will automatically assess whether students meet the eligibility criteria for tuition waivers, and we will also promote eligible candidates for scholarships provided by external funders.

What level of English do I need to have for this Master’s?

An advanced level of English is required, we accept the following as proof: TOEFL score of 90 or above; IELTS Academic Test score of 6.5 or above; Duolingo English Test 120 points

Do I need to take the GRE General Test to apply?

We highly recommend submitting the GRE General Test as part of your application, but it is optional

Can I enter another BSE Master's directly from this program?

Students who successfully complete the Macroeconomic Policy and Financial Markets Program are eligible for direct admission to the following programs, if they stay for a second consecutive year:

Master’s Degree in Data Science:

OR

Master’s Degree in Economics and Finance:

A 20% discount will be applied on the second program’s tuition fees. All BSE Alumni are eligible for this discount at any time. Learn more about taking a second BSE Master’s degree.

Related Master’s Programs

International Trade, Finance, and Development Program

Economics of Energy, Climate Change, and Sustainability Program

Economics of Public Policy Program

Competition, Regulation, and Markets Program

Related Research Publications

See allEconomics. All rights reserved.